The U.S. economy saw a modest rise in inflation during July, with core prices edging up at the expected rate, according to recent data from the Commerce Department. The increase in inflation, which has been closely monitored by both consumers and policymakers, is consistent with ongoing economic trends, signaling potential movements in Federal Reserve policies.

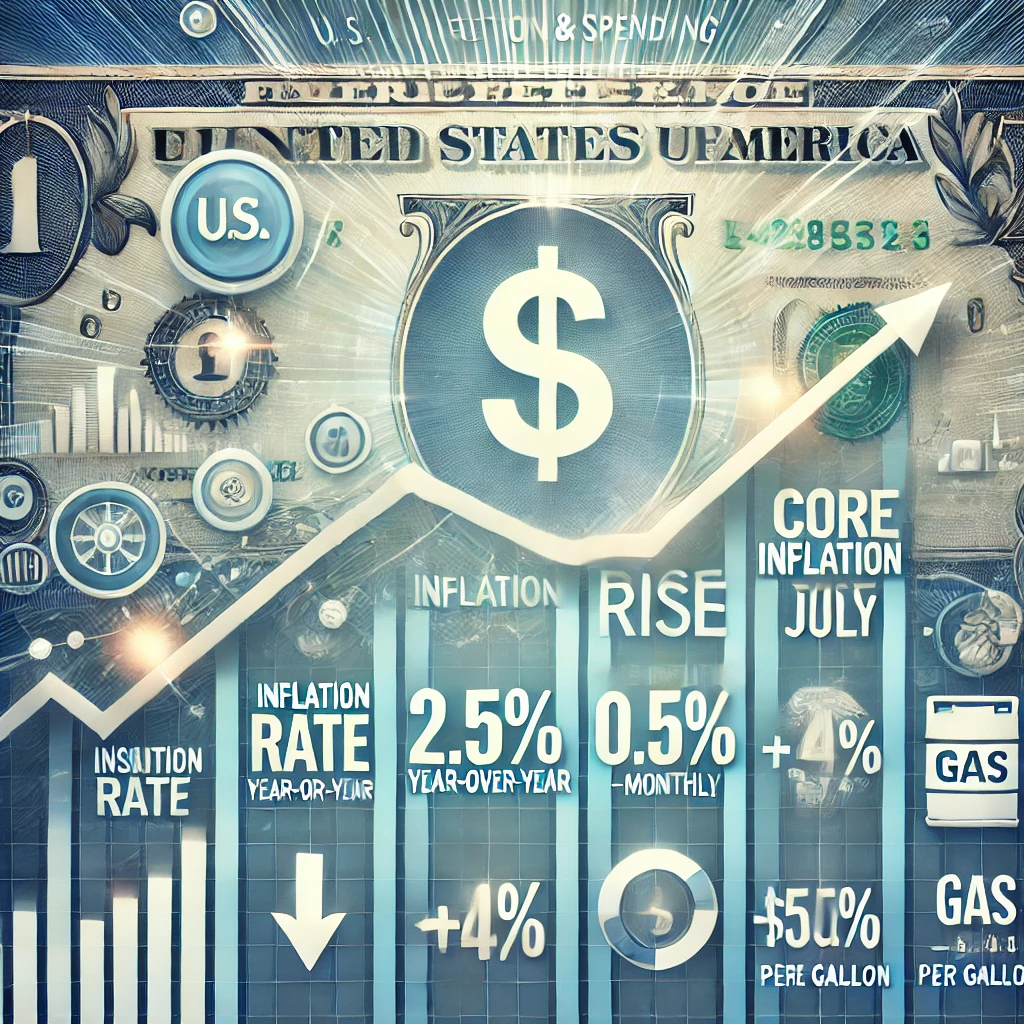

July’s inflation data comes as part of the Personal Consumption Expenditures (PCE) report, a key measure of inflation that tracks changes in the prices of goods and services. The PCE report revealed that core inflation, which excludes volatile food and energy prices, rose by 0.2% from the previous month. This brings the year-over-year core inflation rate to 2.5%, the lowest since early 2021. The report suggests that while prices continue to rise, the rate of increase is slowing—a phenomenon known as disinflation.

The Federal Reserve has been vigilant in its efforts to control inflation while supporting economic growth. The latest PCE data may provide the “green light” for the Federal Reserve to consider cutting interest rates in its upcoming September meeting. This potential policy shift is seen as crucial in maintaining economic stability, particularly as inflation, though moderated, remains a significant concern for American households.

Jared Bernstein, Chairman of the Council of Economic Advisers, highlighted two major takeaways from the July report. First, he noted that inflation continues to ease, which is crucial not only for the Federal Reserve’s policy decisions but also for the economic well-being of working Americans. “Wages and incomes are now consistently outpacing prices, meaning that the purchasing power of paychecks is growing,” Bernstein said. This increase in real income is helping consumers better manage rising costs, particularly in essential areas like groceries and housing.

In addition to the encouraging signs on inflation, the report also showed strong consumer spending in July, with a 4% increase for the month and a nearly 3% rise compared to the same period last year. This robust spending indicates that the U.S. economy has significant momentum, supported by rising real pay and lower gas prices. Gas prices, in particular, are about 50 cents per gallon lower than they were a year ago, providing some relief to consumers as they navigate a still-challenging economic environment.

Chocolate Prices Could Stay High Until 2026, Experts Warn

The PCE report also sheds light on the Federal Reserve’s concerns about inflation in the service sector, where wage pressures have been notable. However, the data suggests that even in this sector, inflation is easing, offering the Federal Reserve more flexibility in pursuing its policy goals.

As the U.S. heads into Labor Day weekend, the latest inflation data underscores the ongoing efforts by the Biden administration to tackle high prices. The administration has been focusing on reducing costs in critical areas such as prescription drugs, child care, and housing. Vice President Kamala Harris has been particularly vocal about the need for more affordable housing, a long-standing issue that the administration aims to address through targeted policies.

Looking ahead, the focus will likely remain on how these economic trends evolve and how they influence the Federal Reserve’s decisions in the coming months. While the July PCE report provides some optimism, the path to sustained economic stability will require continued vigilance and strategic policy adjustments.